In the financial world, the S&P 500 index is considered one of the most widely followed benchmarks for the overall performance of the stock market in the United States. Investors often look to the S&P 500 as a key indicator of market health and outlook. Recently, there has been speculation surrounding the possibility of the S&P 500 breaking the 6000 mark. However, there are several factors that suggest this milestone may not be achieved just yet.

One primary reason why the S&P 500 may not break 6000 in the near future is the current macroeconomic environment. The global economy is facing significant challenges, including supply chain disruptions, inflationary pressures, and geopolitical uncertainties. These factors have created a sense of volatility and uncertainty in the markets, making investors cautious about pushing the S&P 500 to new highs.

Additionally, the Federal Reserve’s monetary policy stance plays a crucial role in determining the direction of the stock market. The Fed’s actions, including interest rate decisions and bond purchase programs, have a direct impact on market sentiment and investors’ risk appetite. As the Fed gradually tightens its monetary policy to combat inflation, it could potentially dampen the prospects of a significant rally in the S&P 500 in the short term.

Furthermore, corporate earnings growth, which is a key driver of stock market performance, may not be robust enough to propel the S&P 500 to the 6000 level. While many companies have reported strong earnings in recent quarters, there are concerns about the sustainability of this growth amidst rising costs and uncertain economic conditions. If corporate profits fail to meet expectations, it could restrain the upward momentum of the S&P 500.

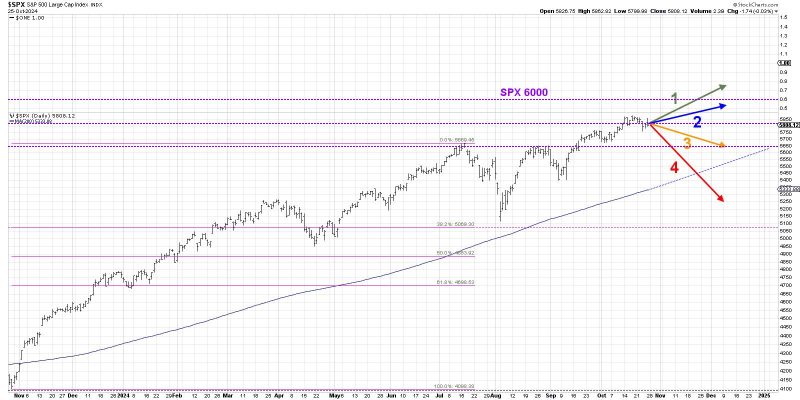

Moreover, technical analysis of the S&P 500 chart also indicates that the index may encounter resistance before reaching the 6000 level. Key technical indicators, such as moving averages, relative strength index (RSI), and Fibonacci retracement levels, suggest that the market may need to consolidate or correct before making a sustained push towards new highs. This consolidation phase could provide a healthy basis for future growth but may delay the ascent to the 6000 mark.

In conclusion, while the prospect of the S&P 500 breaking 6000 is an enticing possibility for investors, there are several reasons why this milestone may not be reached in the immediate future. The macroeconomic environment, monetary policy decisions, corporate earnings growth, and technical factors all point towards a potential delay in the index’s rise to new highs. As always, it is essential for investors to carefully analyze these factors and exercise caution in navigating the ever-evolving landscape of the stock market.