How to Invest in Tin Stocks: A Comprehensive Guide for 2024

Understanding the Tin Market and Its Importance

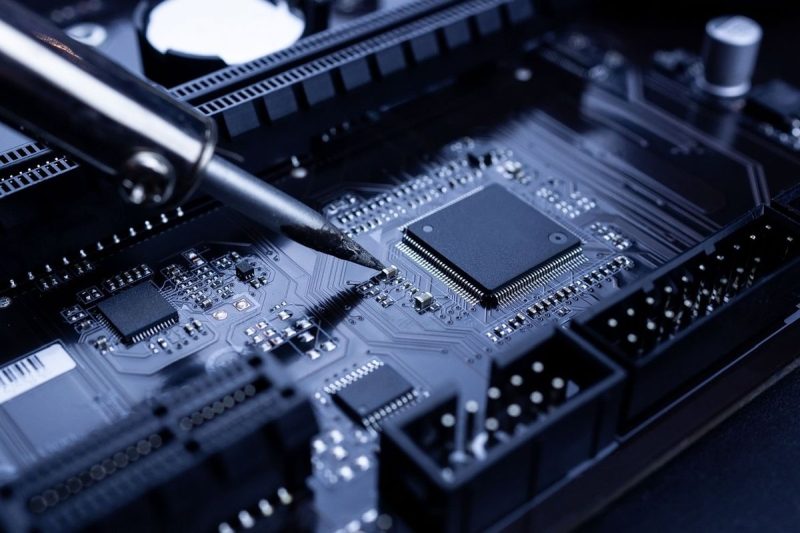

Tin has been a crucial metal used in various industries, primarily in electronics, packaging, construction, and automotive sectors. With its unique properties, including corrosion resistance and high tensile strength, tin plays a vital role in modern manufacturing processes. The global demand for tin continues to rise, driven by the ongoing technological advancements and the shift towards sustainable practices across industries.

Factors Influencing the Tin Market

Several key factors influence the tin market, affecting its supply and demand dynamics. Geopolitical tensions, trade policies, economic conditions, and environmental regulations all play a significant role in shaping the tin market’s trajectory. Supply disruptions due to mining activities, natural disasters, or political unrest can impact tin prices and create investment opportunities for savvy investors.

Investing in Tin Stocks: Steps to Consider

1. Research and Analysis: Before investing in tin stocks, it is essential to conduct thorough research on the companies operating in the tin mining and production sector. Assess their financial health, growth prospects, market positioning, and exposure to geopolitical risks. Look for companies with a reliable track record, strong management team, and solid growth potential.

2. Diversification: Diversifying your investment portfolio is crucial to mitigate risks associated with individual stocks. Consider investing in a mix of tin mining companies, producers, and related industries to spread out your risk exposure and capture potential opportunities in different segments of the tin market.

3. Market Timing: Timing your entry and exit points in the tin market is critical for maximizing returns and minimizing losses. Monitor macroeconomic indicators, industry trends, and company-specific developments to identify the right timing for investing in tin stocks. Utilize technical and fundamental analysis tools to make informed investment decisions.

4. Risk Management: Investing in tin stocks involves certain risks, including price volatility, market fluctuations, and regulatory changes. Implement risk management strategies, such as setting stop-loss orders, diversifying your investments, and keeping a long-term investment perspective. Stay informed about market developments and adjust your investment strategies accordingly.

5. Continuous Monitoring: The tin market is dynamic and subject to various external factors that can impact stock prices. Stay informed about industry news, market trends, and company updates to make informed decisions about your investments. Regularly review your investment portfolio and adjust your holdings based on changing market conditions.

Conclusion

Investing in tin stocks can offer attractive growth opportunities for investors looking to capitalize on the increasing demand for this essential metal. By conducting thorough research, diversifying your portfolio, timing your investments strategically, managing risks effectively, and staying informed about market developments, you can maximize your investment potential in the tin market. Stay vigilant, be patient, and take a proactive approach to navigate the evolving landscape of the tin market and achieve your investment goals.