In the world of finance and investing, the decision to cut or raise interest rates can have a profound impact on stock performance. As central banks around the world grapple with economic uncertainties, investors often find themselves at a crossroads trying to determine whether to be bullish or bearish in the face of rate cuts. This article seeks to shed light on the truth behind rate cuts and their impact on stock performance.

The Effect of Rate Cuts on Stock Markets

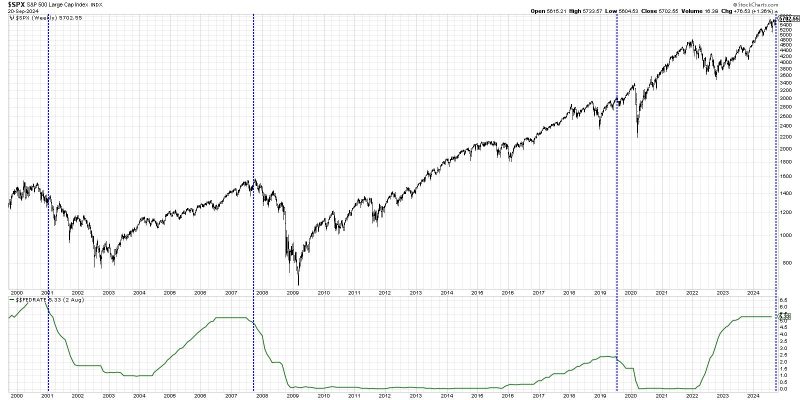

Historically, rate cuts by central banks have been seen as a positive signal for stock markets. Lower interest rates reduce the cost of borrowing, making it cheaper for companies to raise capital for expansion and investment. This influx of capital tends to drive up stock prices as investors anticipate higher corporate earnings in the future.

However, the relationship between rate cuts and stock performance is not always straightforward. In some cases, rate cuts may be perceived as a sign of economic weakness, leading to fears of a recession. This can cause volatility in stock markets as investors grapple with uncertainty about the future direction of the economy.

Market Sentiment and Rate Cuts

Market sentiment plays a crucial role in determining the impact of rate cuts on stock performance. If investors interpret rate cuts as a proactive measure by central banks to support economic growth, market sentiment may turn positive, leading to a rally in stock prices. On the other hand, if rate cuts are seen as a reaction to economic slowdown or geopolitical risks, investor confidence may wane, leading to a sell-off in stocks.

The Timing of Rate Cuts

Timing is key when it comes to rate cuts and stock performance. Central banks typically cut interest rates in response to changing economic conditions, such as slowing growth or rising inflation. Investors need to pay close attention to the timing of rate cuts and the rationale behind them to assess their impact on stock markets accurately.

The Global Perspective

Rate cuts and their impact on stock performance are not limited to any one country or region. In the interconnected world of finance, decisions made by central banks in one part of the world can have far-reaching implications on stock markets globally. Investors need to take a global perspective when considering the impact of rate cuts on their investment portfolios.

Conclusion

In conclusion, the truth about rate cuts and stock performance is nuanced and multifaceted. While rate cuts can provide a boost to stock markets by lowering the cost of capital and stimulating economic growth, they can also reflect underlying uncertainties and risks in the economy. By understanding the relationship between rate cuts, market sentiment, timing, and global dynamics, investors can make informed decisions about their investments in the face of changing interest rate environments.