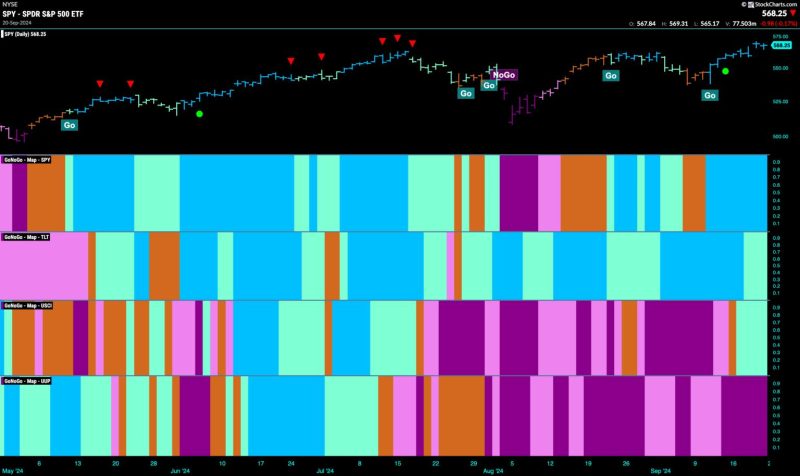

Equities Remain in Strong ‘Go’ Trend, Powered by Financials

The current market trend for equities remains robust, with financial stocks emerging as key drivers of this positive momentum. As investors navigate the ever-changing landscape of market conditions and economic indicators, it becomes crucial to understand the role of financials in sustaining the upward trajectory of equities.

Financial sector stocks have been instrumental in fueling the current ‘Go’ trend in equities. These companies encompass a diverse range of institutions, including banks, insurance companies, investment firms, and other entities that provide essential financial services. Given their integral role in the economy, the performance of financial stocks serves as a barometer for overall market health.

Several factors contribute to the strength of financial sector stocks within the equities market. One significant driver is the prevailing low-interest-rate environment, which has supported borrowing and lending activities. Low-interest rates make capital more accessible and affordable for businesses and consumers, promoting spending and investment.

Additionally, the ongoing economic recovery from the COVID-19 pandemic has bolstered confidence in financial markets. As businesses rebound and consumer spending rebounds, financial institutions stand to benefit from increased demand for their products and services. The resilience of the financial sector amidst economic challenges underscores its importance in driving the broader equities market.

Furthermore, regulatory and policy developments play a crucial role in shaping the performance of financial stocks. Changes in regulations, such as those related to banking practices, capital requirements, and consumer protection, can impact the profitability and outlook of financial institutions. As policymakers enact reforms to address emerging challenges, investors must stay attuned to regulatory shifts that may affect financial stocks.

Technology and innovation are also reshaping the financial sector, introducing new opportunities and challenges for market participants. Fintech companies, for instance, are disrupting traditional financial services by offering innovative digital solutions for payments, lending, and investing. As these technological advancements gain traction, financial institutions must adapt to remain competitive in a rapidly evolving landscape.

Amidst these dynamic forces shaping the financial sector, investors must exercise caution and diligence in navigating the equities market. While the ‘Go’ trend fueled by financials presents lucrative opportunities for growth and returns, it is essential to assess risks, conduct thorough research, and diversify portfolios to mitigate potential downsides.

In conclusion, the strong ‘Go’ trend in equities, powered by financial sector stocks, underscores the resilience and vitality of these market participants. As financial institutions continue to drive market momentum through their products, services, and innovations, investors must remain vigilant and informed to capitalize on opportunities while managing risks effectively. By staying abreast of market dynamics and industry trends, investors can leverage the strength of financials to navigate the ever-changing landscape of the equities market successfully.