Broad-Based Stock Market Selloff: How to Position Your Portfolio Effectively

1. **Understand the Current Market Situation**

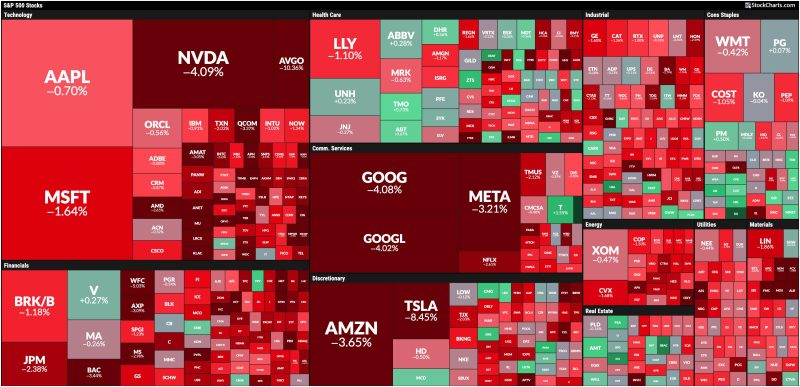

– The first step in effectively positioning your portfolio during a broad-based stock market selloff is to understand the current market situation. Assess the reasons behind the selloff, whether they are due to external factors like economic indicators or global events, or if they are industry-specific.

2. **Diversification as a Key Strategy**

– Diversification is a tried-and-true strategy for managing risk in your investment portfolio. Ensure that your assets are spread across different sectors, industries, and asset classes so that you are not overly exposed to any one particular area that may be particularly hard hit during a selloff.

3. **Reassess Risk Tolerance and Investment Goals**

– During a stock market selloff, volatility tends to increase, and the value of many assets may experience significant fluctuations. Take this opportunity to reassess your risk tolerance and investment goals. Are you comfortable with the level of risk in your portfolio, or do you need to make adjustments to better align with your long-term objectives?

4. **Consider Defensive Stock and Bond Investments**

– Defensive stocks are those that tend to be less sensitive to economic cycles and market downturns. These can include sectors such as healthcare, consumer staples, and utilities. Additionally, high-quality bonds can provide stability and income during turbulent market conditions.

5. **Opportunities in Value Investing**

– A stock market selloff often presents opportunities for value investors. Look for undervalued stocks with strong fundamentals that have been oversold due to market sentiment. These investments may offer significant upside potential once market conditions stabilize.

6. **Stay Informed and Remain Patient**

– During a broad-based stock market selloff, it can be tempting to make impulsive decisions based on fear or panic. However, it is important to stay informed, remain patient, and avoid knee-jerk reactions. Stick to your investment strategy and focus on the long-term outlook for your portfolio.

7. **Utilize Professional Advice**

– If you are uncertain about how to navigate a stock market selloff or feel overwhelmed by the complexity of the situation, consider seeking professional advice. Financial advisors or investment professionals can provide valuable insights and guidance tailored to your individual circumstances.

8. **Regularly Review and Rebalance Your Portfolio**

– Finally, regularly review and rebalance your investment portfolio to ensure that it remains aligned with your financial goals and risk tolerance. Rebalancing can help you take advantage of opportunities in a selloff and maintain a well-diversified portfolio over the long term.