In the fast-paced world of investing, the strategy of sector rotation plays a crucial role in investors’ portfolios. Sector rotation involves shifting investments from one sector of the economy to another based on a variety of factors such as economic conditions, market trends, and company performance. This strategy aims to capitalize on the different stages of the economic cycle and maximize returns while managing risk.

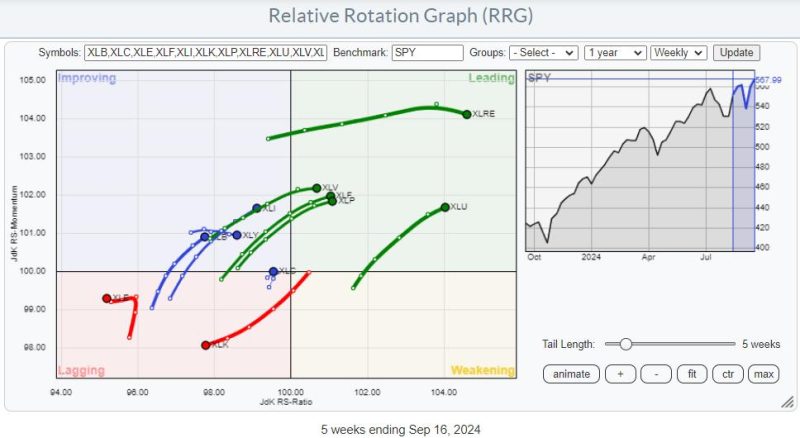

Understanding the sector rotation dilemma requires a deep dive into the complexities of the financial markets. As economic conditions change, certain sectors tend to outperform while others lag behind. Investors often face the dilemma of whether to stick with their current investments or rotate into other sectors to capture better returns.

One of the key challenges in sector rotation is timing. Predicting when a specific sector will outperform or underperform is not an exact science. Market timing requires a combination of research, analysis, and sometimes a bit of luck. Investors need to be aware of market indicators, economic data, and geopolitical events that can impact sector performance.

Another aspect of the sector rotation dilemma is balancing risk and return. Some sectors may offer high potential returns but come with higher levels of risk. On the other hand, defensive sectors may provide stability and lower risk but offer limited growth opportunities. Finding the right balance between risk and return is essential for successful sector rotation.

Moreover, sector rotation can be influenced by various external factors such as government policies, interest rates, and technological advancements. For example, changes in regulation or trade policies can significantly impact certain sectors such as healthcare, financials, or energy. Keeping abreast of these external factors is vital for making informed investment decisions.

The rise of exchange-traded funds (ETFs) has made sector rotation more accessible to individual investors. ETFs that track specific sectors or industries offer a convenient way to gain exposure to different sectors without the need to pick individual stocks. This diversification can help mitigate risk and streamline the sector rotation process.

In conclusion, navigating the sector rotation dilemma requires a combination of research, analysis, and strategic decision-making. While sector rotation can enhance portfolio returns and manage risk, it also comes with its challenges and uncertainties. Investors must stay informed, adapt to changing market conditions, and remain disciplined in their investment approach to successfully navigate the sector rotation dilemma.