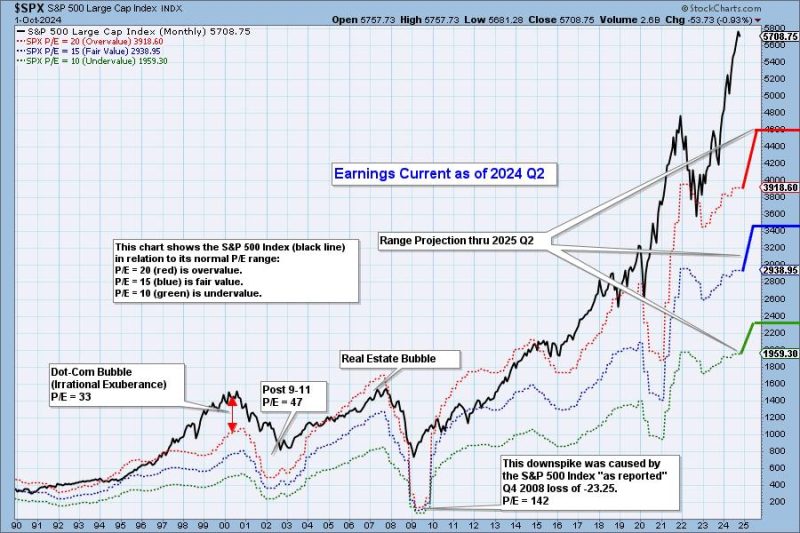

The website godzillanewz.com recently reported on the state of the market in relation to the Q2 earnings of 2024. The assessment indicates that the market remains very overvalued, raising concerns among investors and analysts alike.

The overvaluation of the market is a significant issue that has been looming for quite some time. With the current state of the economy, many experts have been cautioning about the unsustainable levels of valuation across various sectors. The Q2 earnings of 2024 seem to have only exacerbated this concern, as the market continues to soar to unprecedented heights.

One key factor contributing to the overvaluation is the influx of liquidity in the market. With central banks around the world pumping trillions of dollars into the economy, asset prices have been artificially inflated. This abundance of cheap money has led to a speculative frenzy, with investors piling into stocks, cryptocurrencies, and real estate in search of higher returns.

Moreover, the low interest rate environment has further fueled the overvaluation of the market. With borrowing costs at historic lows, companies have been able to finance their operations and expansion projects at very favorable rates. This has resulted in a surge in corporate earnings, which has in turn propped up stock prices.

Another critical aspect that has contributed to the overvaluation is the influence of retail investors. The rise of commission-free trading platforms and the gamification of investing have lured millions of retail traders into the market. This influx of retail money has distorted market dynamics, leading to pockets of irrational exuberance and heightened volatility.

Furthermore, the prevalence of algorithmic trading has added another layer of complexity to the issue of overvaluation. High-frequency trading algorithms can execute trades at lightning speed based on pre-defined criteria, exacerbating market movements and creating artificial price fluctuations.

In conclusion, the market’s overvaluation in the wake of the 2024 Q2 earnings is a cause for concern. The various factors at play, including excess liquidity, low interest rates, retail frenzy, and algorithmic trading, have combined to create a precarious situation. Investors should exercise caution and conduct thorough research before making investment decisions in such a volatile and overvalued market.