In the dynamic world of financial markets, keeping an eye on key indicators and trends can help investors make informed decisions. One such indicator that holds significant importance is the Nifty 50 index. This index, which tracks the performance of the top 50 companies listed on the National Stock Exchange of India (NSE), provides valuable insights into the overall direction of the Indian stock market.

Market analysts and traders often rely on technical analysis to interpret the movements of the Nifty 50 index and identify potential trading opportunities. By studying historical price data, chart patterns, and various technical indicators, investors attempt to forecast future price movements and make profitable trades.

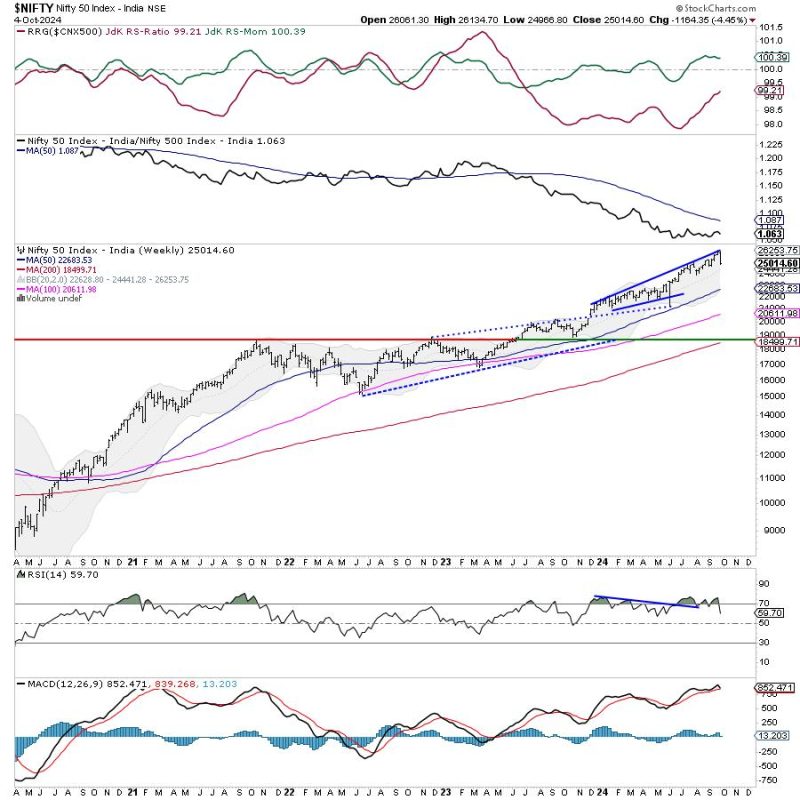

One important aspect to consider when analyzing the Nifty 50 index is the influence of key support and resistance levels. These levels, which are based on past price movements, represent points on the chart where the index is likely to encounter buying or selling pressure. Traders often use these levels to determine entry and exit points for their trades, as well as to set stop-loss orders to manage risk.

In addition to support and resistance levels, traders also pay close attention to major chart patterns that can provide insights into future price movements. Patterns such as head and shoulders, triangles, and double tops or bottoms are often used to predict potential reversals or continuations in the market.

Moreover, popular technical indicators like moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence) are frequently utilized to confirm trading signals and identify overbought or oversold conditions in the market.

It’s essential for traders to remain adaptable and adjust their strategies based on changing market conditions. By combining technical analysis with fundamental analysis, which involves assessing factors like economic indicators, corporate earnings, and geopolitical events, investors can gain a comprehensive understanding of the market environment and make well-informed decisions.

Ultimately, successful trading in the Nifty 50 index requires a disciplined approach, continuous learning, and the ability to stay patient during volatile market conditions. By staying informed, utilizing technical tools effectively, and adhering to a well-defined trading plan, investors can navigate the ups and downs of the market and potentially achieve their financial goals.