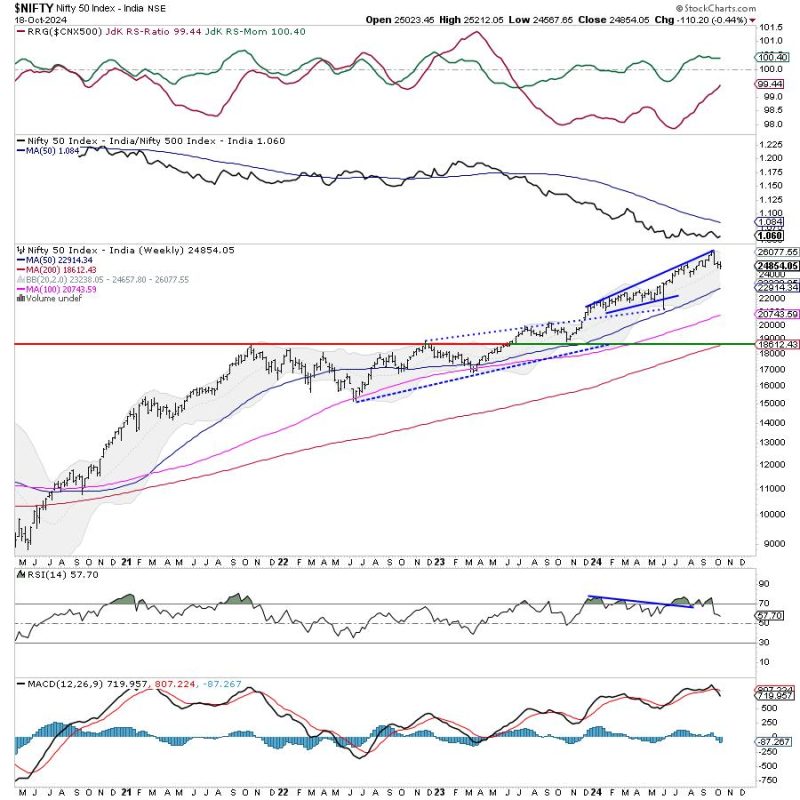

The article discusses the potential price action for the Nifty index in the upcoming week and highlights key levels that could trigger trending moves in either direction. Market analysts have indicated that the index is likely to remain in a range-bound pattern unless specific support and resistance levels are breached.

According to technical analysis, the Nifty index has been consolidating within a certain range, with key support at 14,400 and resistance at 14,800. The article emphasizes that breaching these levels decisively could lead to significant trending moves in the market.

Market participants are advised to monitor closely the behavior of the index around these key levels. A breakout above the resistance level of 14,800 could indicate a bullish trend, potentially leading to further upside momentum. Conversely, a breakdown below the support level of 14,400 could signal a bearish trend and trigger a downward movement in the market.

Furthermore, the article cautions traders to be alert for false breakouts, which occur when the index briefly moves beyond a key level but fails to sustain the momentum. False breakouts can mislead traders and result in potential losses, so it is essential to wait for confirmation before making trading decisions based on such movements.

In conclusion, while the Nifty index is expected to stay within a range in the upcoming week, the possibility of trending moves exists if certain key levels are breached. Traders are advised to exercise caution, wait for confirmations, and employ appropriate risk management strategies to navigate potential market volatility successfully.