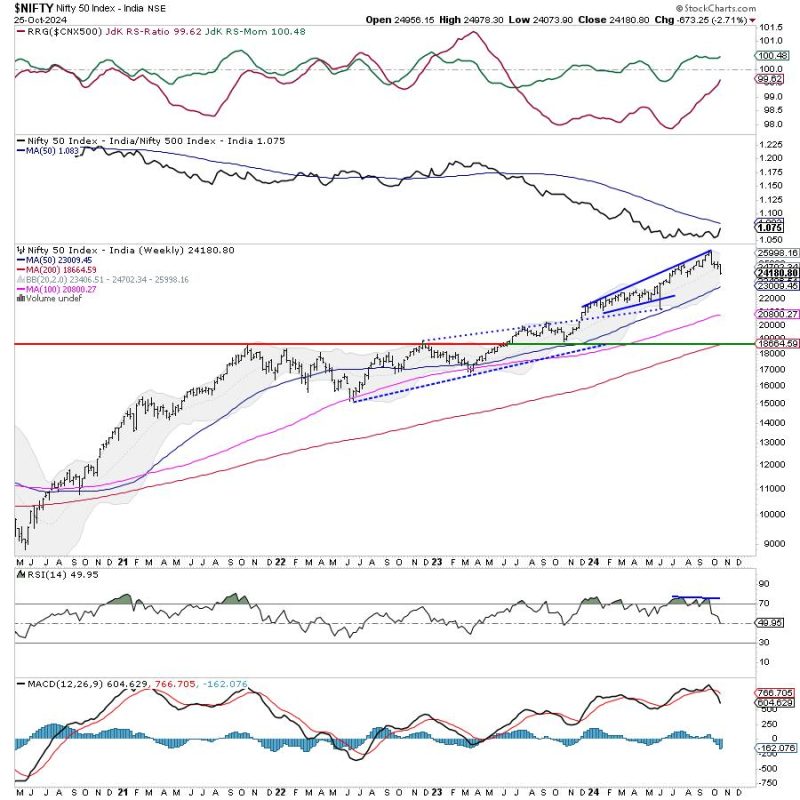

In the realm of stock market investing, the Nifty index plays a vital role, presenting investors with key insights into market trends and potential opportunities. Recently, the Nifty index experienced a shifting landscape as it violated crucial support levels, consequently exerting downward pressure on resistance levels. This development has significant implications for investors and traders alike, heralding potential challenges and opportunities in the coming trading sessions.

One of the primary consequences of Nifty violating key support levels is the increased likelihood of market volatility. As support levels are breached, it often triggers a domino effect of selling pressure and uncertainty among market participants. Investors may react by liquidating their positions or adopting a more cautious approach, leading to increased fluctuations in stock prices. Consequently, traders need to be prepared for heightened market volatility and its impact on their investment strategies.

Moreover, the breach of support levels on the Nifty index can also signal a shift in market sentiment and trend direction. Support levels are crucial indicators of market strength and the willingness of investors to buy at specific price points. When these levels are broken, it may indicate a weakening of bullish sentiment and a potential transition to a bearish market environment. Traders should closely monitor market sentiment indicators and trend analyses to adapt their strategies accordingly and capitalize on emerging opportunities in a changing market landscape.

Furthermore, the violation of key support levels on the Nifty index can have a cascading effect on other market indices and individual stocks. As the Nifty serves as a broad barometer of market performance, its movements can influence investor sentiment across various sectors and industries. Traders should pay close attention to correlated assets and sectoral indices to gauge the overall market direction and identify potential trading opportunities in affected stocks. By conducting thorough fundamental and technical analysis, traders can position themselves strategically to navigate volatile market conditions and capitalize on shifting trends.

In conclusion, the recent violation of key support levels on the Nifty index underscores the dynamic nature of the stock market and the importance of adaptability in trading strategies. Traders must be vigilant in monitoring market developments, analyzing trends, and adjusting their positions to navigate changing market conditions effectively. By staying informed, employing risk management strategies, and leveraging market insights, traders can position themselves for success in the face of evolving market dynamics.