The article you provided discusses the ongoing secular bull market and significant rotations taking place within the market dynamics. It highlights the factors influencing the shifting tides of market sentiment and provides insights into the implications for investors. In line with the source article, let’s delve deeper into the concept of secular bull markets, the significance of market rotations, and how investors can navigate these changes effectively.

Understanding Secular Bull Markets and Market Rotations

Secular bull markets are prolonged periods of rising stock prices, generally lasting ten years or more, driven by improving economic conditions, low interest rates, and investor optimism. These bullish phases are characterized by strong market performance across different sectors and asset classes, leading to substantial gains for investors.

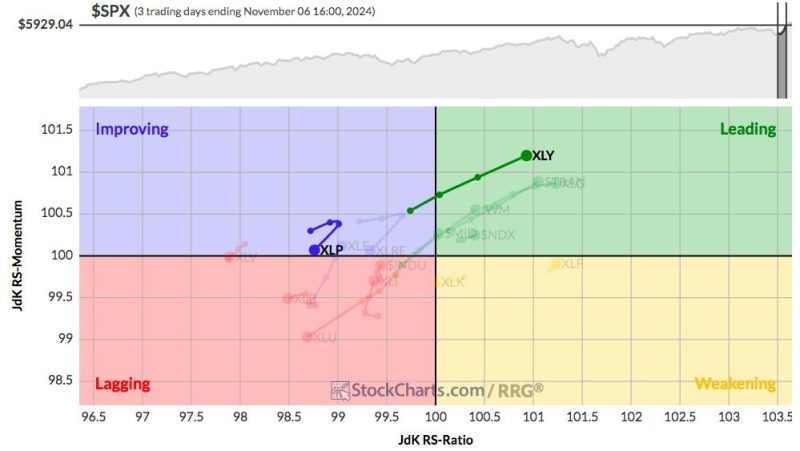

However, within secular bull markets, there are phases of rotation where the leadership in terms of stock performance shifts from one sector to another. These rotations can occur due to various factors such as changes in economic conditions, shifts in investor sentiment, or specific catalysts affecting certain industries.

Navigating Market Rotations: Strategies for Investors

For investors, understanding and adapting to market rotations are crucial for maximizing returns and managing risks in their investment portfolios. Here are some strategies to navigate market rotations effectively:

1. Diversification: Maintaining a well-diversified portfolio across various sectors and asset classes can help mitigate risks associated with sector rotations. By spreading investments across different industries, investors can cushion the impact of underperformance in any single sector.

2. Stay Informed: Keeping abreast of market trends, economic indicators, and geopolitical developments is essential for identifying potential rotation opportunities. Investors should conduct thorough research and analysis to anticipate shifts in market leadership and adjust their portfolios accordingly.

3. Active Portfolio Management: During market rotations, actively managing your portfolio by rebalancing holdings, reallocating assets, and identifying new investment opportunities can help capitalize on emerging trends and outperform the market.

4. Flexibility and Adaptability: Successful investors demonstrate flexibility and adaptability in response to changing market conditions. Being open to adjusting investment strategies, exploring new sectors, and embracing innovative approaches can position investors to thrive in evolving market environments.

5. Risk Management: While capitalizing on market rotations can offer lucrative opportunities, it is essential to manage risks effectively. Setting stop-loss orders, diversifying holdings, and employing risk management techniques can help protect investments during volatile market cycles.

Conclusion

In conclusion, navigating secular bull markets and market rotations requires a proactive approach, informed decision-making, and strategic portfolio management. By understanding the dynamics of market cycles, identifying rotation opportunities, and implementing sound investment strategies, investors can position themselves for long-term success and capitalize on the ever-changing landscape of the financial markets.