Investing in Chromium Stocks: A Lucrative Opportunity for 2024

Understanding the Chromium Market Dynamics

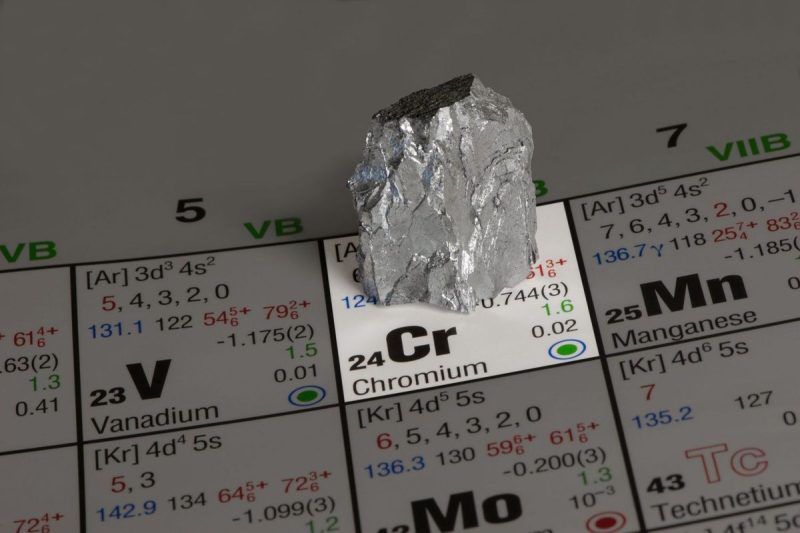

Before delving into the specifics of investing in chromium stocks in 2024, it is crucial to comprehend the market dynamics surrounding chromium. Chromium is a crucial industrial metal that sees extensive usage across various sectors including stainless steel production, aerospace, automotive, and electronics. The global demand for chromium continues to be robust, driven by the burgeoning infrastructure development projects and the increasing demand for durable materials.

Factors to Consider Before Investing in Chromium Stocks

1. Growth Prospects of the Stainless Steel Industry

The stainless steel industry is one of the primary consumers of chromium, accounting for a significant portion of its demand. Investors looking to capitalize on chromium stocks in 2024 should closely monitor the growth prospects of the stainless steel sector. Factors such as infrastructure development, urbanization, and increasing industrialization can serve as indicators of the stainless steel industry’s future demand for chromium.

2. Global Chromium Supply and Demand Situation

A comprehensive understanding of the global chromium supply and demand dynamics is crucial for investors. Factors such as production trends, geopolitical factors impacting supply chains, and new mining projects can influence the pricing and availability of chromium. Monitoring these factors can provide valuable insights into the market’s future outlook.

3. Technological Advancements and Innovations

Technological advancements play a pivotal role in shaping the chromium market. Innovations in stainless steel production processes, recycling technologies, and the emergence of new applications for chromium can drive demand and impact stock prices. Investors should stay informed about the latest technological developments in the chromium industry to make informed investment decisions.

4. Regulatory Environment and Sustainability Initiatives

The regulatory landscape surrounding chromium mining and processing can significantly impact the industry’s profitability. Investors should stay informed about environmental regulations, sustainability initiatives, and responsible mining practices adopted by chromium producers. Companies adhering to stringent environmental standards are likely to enjoy a competitive advantage and attract investment interest.

Strategies for Investing in Chromium Stocks in 2024

1. Diversification: Diversifying your investment portfolio to include a mix of chromium mining companies, stainless steel manufacturers, and related industries can help mitigate risks and optimize returns. Consider investing in a combination of established players and promising newcomers to leverage the sector’s growth potential.

2. Long-term Investment Horizon: Investing in chromium stocks requires a long-term perspective, considering the cyclical nature of commodity markets. Patient investors willing to ride out market fluctuations and capitalize on the industry’s long-term growth trajectory stand to benefit from investing in chromium stocks.

3. Conduct Thorough Research: Before committing your capital to chromium stocks, conduct thorough research on the companies, industry trends, and market dynamics. Analyze financial reports, industry publications, and expert opinions to gain valuable insights into the investment landscape and make informed decisions.

4. Monitor Market Trends: Stay abreast of market trends, geopolitical events, and macroeconomic indicators that can impact chromium prices and stock performance. Develop a robust monitoring system to track relevant information and adjust your investment strategy accordingly to capitalize on emerging opportunities.

In Conclusion

Investing in chromium stocks in 2024 presents a compelling opportunity for investors seeking exposure to the industrial metal sector. By understanding the market dynamics, conducting thorough research, and adopting a strategic investment approach, investors can position themselves to benefit from the robust demand for chromium in key industries. Stay informed, diversify your portfolio, and maintain a long-term perspective to maximize the potential returns from investing in chromium stocks.