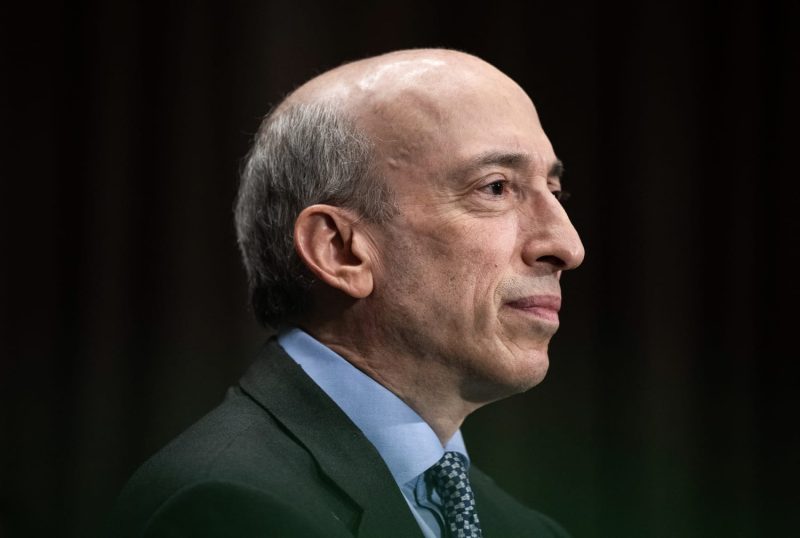

In a surprising turn of events, SEC Chair Gary Gensler announced his decision to step down on January 20th, paving the way for a potential replacement by former President Donald Trump. This development has sent shockwaves through the financial world, as Gensler’s term was marked by significant regulatory changes aimed at increasing transparency and accountability in the securities industry.

During his tenure, Gensler made a name for himself as a strong advocate for investor protection and market integrity. He spearheaded efforts to enhance oversight of cryptocurrencies and digital assets, recognizing the need to adapt regulations to the evolving landscape of finance. Gensler’s proactive approach to regulating emerging technologies earned him both praise and criticism, as he navigated the complex intersection of innovation and investor safeguards.

However, Gensler’s departure creates uncertainty about the future direction of the SEC. The appointment of a new chair, particularly one endorsed by the previous administration, raises questions about the continuity of Gensler’s regulatory initiatives. Will the SEC maintain its focus on enhancing transparency and investor protection, or will there be a shift towards deregulation and industry-friendly policies under new leadership?

The timing of Gensler’s resignation, just as the Biden administration settles into office, adds a layer of intrigue to the situation. With potential political considerations at play, the selection of his successor becomes a crucial decision that could shape the trajectory of financial regulation for years to come. Investors and industry stakeholders alike will be closely monitoring developments to gauge the impact of this leadership transition on the securities market.

As the SEC prepares for a changing of the guard, market participants are bracing for potential shifts in regulatory priorities and enforcement strategies. The legacy of Gary Gensler looms large over the agency, as his tenure leaves a lasting imprint on the regulatory framework governing the securities industry. Whether his successor will build upon this foundation or steer the SEC in a new direction remains to be seen, but one thing is certain – the dynamics of financial regulation are once again in flux.