In the realm of finance, the concept of equity trend analysis holds significant relevance for investors, analysts, and companies seeking to assess their financial health and performance. By diving into equity trends, stakeholders can garner valuable insights into the current and future valuation of assets and leverage this knowledge to make informed decisions. The financial viability and stability of an organization are often closely tied to its equity trends, making it a key area of focus for strategic planning and risk management.

Understanding equity trends involves analyzing the movement of a company’s equity value over a period of time, typically through the examination of key financial ratios, market data, and historical performance. By tracking these trends, investors can gauge the overall health of a company and assess its growth potential, liquidity, and profitability. Equity trend analysis serves as a crucial tool for evaluating investment opportunities, as it allows stakeholders to assess the risks and rewards associated with a particular asset or company.

One of the fundamental elements of equity trend analysis is the evaluation of financial ratios, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and return on equity (ROE). These metrics provide valuable insights into the valuation and profitability of a company, helping investors identify undervalued or overvalued stocks. By comparing these ratios with industry benchmarks and historical data, stakeholders can discern trends and make well-informed investment decisions.

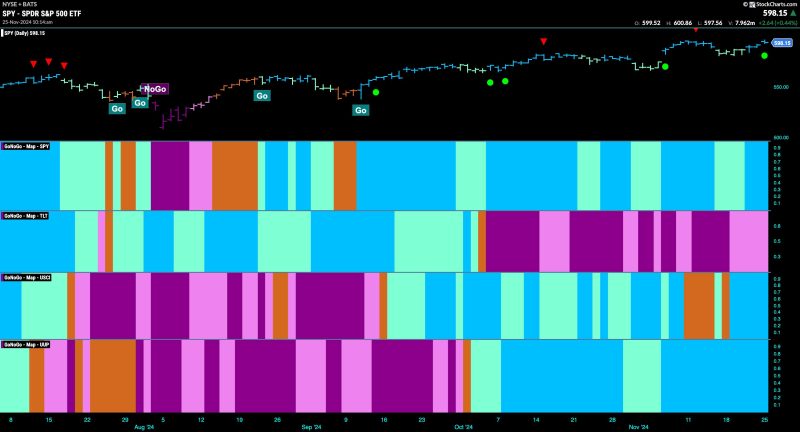

Market data also plays a pivotal role in equity trend analysis, as it provides essential information on stock performance, market trends, and investor sentiment. By examining price movements, trading volumes, and market capitalization, investors can gauge the market’s perception of a company and anticipate future trends. Technical analysis tools, such as moving averages and support-resistance levels, further aid in identifying potential market trends and making timely investment decisions.

Moreover, historical performance is a critical component of equity trend analysis, as it enables stakeholders to assess a company’s track record and project future performance. By evaluating past financial statements, earnings reports, and cash flow data, investors can identify patterns, outliers, and potential risks that may impact future equity trends. Historical analysis also helps in identifying growth opportunities, operational efficiencies, and areas for improvement within a company.

In conclusion, equity trend analysis is a valuable tool for assessing the financial health and performance of companies, as well as making informed investment decisions. By examining financial ratios, market data, and historical performance, stakeholders can gain valuable insights into asset valuation, growth potential, and market trends. Incorporating equity trend analysis into strategic planning and risk management processes can help investors, analysts, and companies navigate the dynamic landscape of finance and achieve sustainable growth and profitability.